Beverage can shipments increased in the US, Europe and Brazil over the first three months of the year, according to reports from the three leading canmakers, Ball, Crown and Ardagh Metal Packaging. It was also apparent that aluminium cans are taking market share from glass bottles, with their recyclability a key factor, and that consumption is rising again after a lacklustre 18 months.

Costs are also declining for the drinks producers as aluminium and energy prices slackened over the past few months. As canmakers pass on these price fluctuations contractually it also means that their top line sales figures are affected.

Coca-Cola reported that its first quarter volumes in North America had a slow start but later showed an improvement, ending about equal with last year. Its strongest growth was said to be in Brazil, up by 4%, with Europe and the Middle East each up by 2%, and Asia down slightly.

The sparkling soft drink brand Coke Zero performed strongly, especially in its new 12oz slim cans. Its sports drink brands gained traction and improved market share. Chief executive James Quincey added that in Latin America, Coke Zero “continued its strong performance”. He added that Fanta performed well in Brazil, Germany and in the US, among other markets.

Anheuser-Busch InBev, the world’s largest brewer, said that volumes in its beer brands fell by 1.3% in the first quarter, led by a drop of 11% in North America, where the impact of consumer backlash against Bud Light that started last April following an ill-advised promotion still continues. But it was offset by growth of 4-5% in Mexico along with in Europe and the Middle East. AB InBev indicated that its Beyond Beer (spirits-based ready-to-drink portfolio) “delivered double-digit volume growth”.

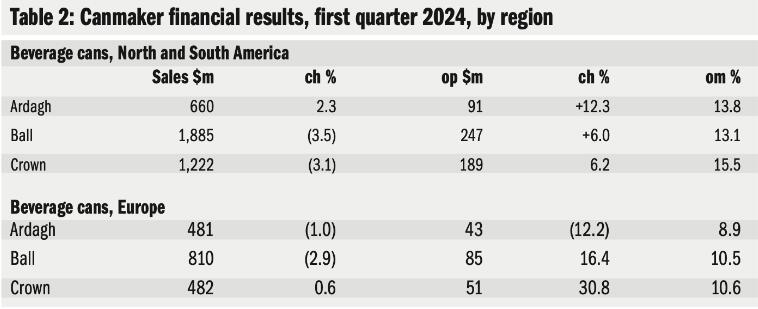

Ardagh Metal Packaging (AMP), the third- largest beverage can producer, reported a strong improvement in shipments and higher segment earnings. Its global volume rose by 7% and operating profit by 3%, in contrast to a decline last year.

Can shipments from its North America plants rose by 13%, supported by new capacity. Chief executive Oliver Graham projected volume to increase by “mid-to- high single digit rates this year, with an uptick in promotional activity”. It is a key player in Brazil, where its volume rose by 4%, “supported by an improving macro- economic environment”.

Graham added that “there is no trend to returnable glass and the expected reversion to cans is happening”. Last year, can shipments were hampered by delays in the startup of the annual Carnival, and in the FIFA World Cup.

In AMP’s European operations, volume rose by 3%, as sales volume recovered following the decrease in the fourth quarter. Revenue fell modestly “due to pass-through of lower input costs to customers”. Last year, it added capacity in the UK, Germany, and in France but the project to build a plant in Northern Ireland is still apparently on hold.

Graham noted that the beer segment recovered strongly, with the producers focused more on volume than price. He added that the company looks for more strength in soft drinks, particularly in the UK, and in energy drinks.

Capital spending to support AMP’s growing market share will fall to US$100m this year, compared to more than $400m last year. In addition its spending on maintenance, IT and other categories is budgeted at $120m this year”. Its net leverage multiple (debt to ebitda) at the end of the quarter was high, at 6.2, but Graham noted that it “anticipates modest leverage reduction as the year progresses”.

Ball showed weakness in North America, but a strong gain in Brazil Ball Corporation reported that its first- quarter global can shipments rose by 3.7% after a decline in the prior quarter. In its largest segment, North and Central America, accounting for 52% of its sales, volume fell by 2.4%, following the continued decline over the previous three quarters. This was related mainly to the disruption in sales of A-B InBev’s Bud Light brand, as discussed in previous articles. On the other hand, soft drinks are a little better and energy drinks continue to fuel demand. In addition, operating profit gain was helped by the closure of its plant at Kent in Washington, which, according to management, helped its “supply-demand balance across its system”.

In Ball’s European and Middle East canmaking operations, accounting for 30% of sales, volume was up by 1.1% in the quarter, rising in the UK, the Nordic countries and in Turkey, following customer destocking in late 2023, offset by lower demand in Egypt. In addition,

said management, “packaging mix shifts to aluminium cans were helped by ongoing packaging legislation in certain counties and continues to be a demand driver”.

Chief executive Dan Fisher added that “the gap has widened probably more in Europe than elsewhere, relative to the tradeoffs from glass to plastics into cans”. Last year, Ball added new canmaking plants at Kettering in the UK and at Pilsen in the Czech Republic.

In South America, led by operations in Brazil, volume rose by a healthy 26%, with some customers shifting to cans from other substrates, and a recovery in beer cans. Fisher said that it “took a bit of the refill business back”. He added that while there was some weakness in Chile, “[the recovery] is all about Brazil and that’s in a really good spot”.

In Ball’s non-reportable business segment, which includes aluminium bottles and aerosol cans, volume was down by 3%. But Ball continues to work on growth opportunities for personal care as well as refillable packaging for water, and other beverages, Furthermore, this category also includes its canmaking business in India, Saudi Arabia and Myanmar. As noted last year, Ball’s aluminium drinking cups business was augmented by 9.1 and 12oz sizes, aiming at the paper and plastic cup market.

Capital spending by Ball in 2024 is expected to be close to $650m, a reduction of $400m from last year, as ongoing projects were completed. Management indicated that it plans to keep spending close to its level of depreciation and amortization.

Crown’s first quarter this year was a bit of a surprise, with stronger volume and improved profit performance. Chief executive Tim Donahue indicated that for Crown its “global beverage can results (in volume) rose by more than 11%, with increased shipments of beverage cans in North America offset by lower volume in Asia”.

He added that the canmaker had added “more than 25 billion units or 30%-plus of annualised beverage can capacity globally”.

In its largest market segment, the Americas, accounting for 62% of its global beverage can sales, volume rose by 5%, reflecting 7% growth in North America and a 1% decline in Brazil. Donahue noted that “while the Brazil market grew by mid-teen [percentages] in the first quarter, Crown’s shipment performance compares with a very strong quarter last year, which grew by 23%”.

In North America, Donahue estimated the overall market to be about 115 to 120 billion beverage cans a year, compared with 90bn before the Covid pandemic. He added that even with 1–2% growth from that base, “volume will grow by 2–3 billion additional units, which might tax industry capacity this year”. He added that “the industry may need to either make more cans early and warehouse them or we need more capacity so that we can meet demand”. On the other hand, he added, if the drinks industry increases its level of promotions, “we could get to 2–4% growth”.

In Europe, Crown’s shipments rose by 5%. Donahue added that volumes “bounced back from the destocking last year due to our weighting toward southern Europe combined with the Gulf States which performed [better] than Northern Europe”. Also last year, volumes in Turkey were hurt by the major earthquake from which the country is still recovering.

An important element in the European market this year is expected to be major soccer and athletics events. According to Donahue, “we’re going to have seven or eight weeks in a row where we go from the European Cup and right into the Olympics beginning in mid-June right to the middle of August”.

In Crown’s Asia Pacific region, volume declined by “double digits” in almost every market. It was noted that this was due to the impact of higher retail prices and overall inflation. The company also noted that the “stressed consumer” in the region led to a slow Chinese New Year and wedding season. Volume in Vietnam was down, but it is expected to recover in the second half. Overall, gains in Asia are expected with more promotions by the brewers, leading to market growth.

Sales in Crown’s Transit Packaging business were lower, with operating income down by 13%, with “price and volume contributing to the decline”. Its protective products business accounted for more than 50% of revenue and was weaker, reflecting a slowdown in the freight industry. It is expected to improve in the second half with better performance by the trucking industry. In its remaining businesses, it showed lower demand for canmaking equipment for beverage and aerosol cans.

Crown noted that capital spending for 2024 will be “no more than $500 million” with free cash flow for the year projected at more than $700m, leading to a reduction of its net leverage. Financial chief David Bourne added that capital spending next year could be “in the order of one-half of that level”.