After the massive growth in global demand for beverage cans in the past two years, volumes slipped at the beginning of the year. But drinks producers are keen for more cans, says Arthur Stupay

The leading global beverage can manufacturers – Ardagh Metal Packaging, Ball Corporation and Crown Holdings – reported declining volumes of units shipped in the US and Europe (excluding Russia) in the first quarter of this year. A recovery is expected, but not until the second half.

The first three months of 2023 offered encouraging news from their customers, the drinks producers. Even with higher costs and some difficulty in getting adequate supplies of cans last year they are adopting the metal can as the primary package for traditional as well as new products, including diet drinks, flavoured water, and energy drinks, among others.

A key factor is that consumers and retailers are especially supportive of the metal can’s easy recyclability. It appears to be a major aspect of the growing sustainability movement, related to efforts in slowing climate change and reducing the consumption of energy and resources. Thus, even with higher metal prices and some problems in getting adequate supplies, the metal can’s popularity continues to build.

First quarter volumes at global drinks industry leader The Coca-Cola Co rose by 3% worldwide, led by the Latin America region – especially Mexico and Brazil – but falling in the EMEA region, while being flat overall in North America. It noted that its Coca-Cola brand worldwide grew by 3%, along with sparkling flavoured drinks, while its Zero Sugar brand grew by 8%. But Coca Cola’s sports drinks declined by 1%. At the same time, PepsiCo reported a 2% fall in volume in North America, but showed a 5% gain in Latin America and 11% drop in Europe.

At world-leading brewer Anheuser-Busch InBev, its own beer brands grew by 0.4% worldwide with its core brands rising by “low single digits”. Its Beyond Beer category, which includes hard seltzers, canned wines and cocktails, rose by “double digits”. In North America, its “own beer” category was down by 1.1% and in the EMEA region volume fell by 1.5%.

Volume growth at AMP is 3% but cash generation low

Can volumes at Ardagh Metal Packaging (AMP), the third largest of the leading global beverage can manufacturers, grew by 3% in the first quarter, in contrast to Ball and Crown.

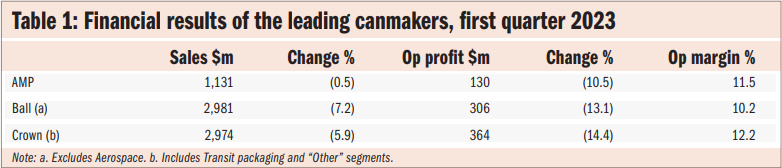

But at the same time, its earnings before interest, tax, depreciation and amortisation (ebitda), a good measure of cash generation, fell by 10.5%, as detailed in Table 1. AMP management reaffirmed earlier volume projections of “mid-to-high single digits and full-year ebitda growth of 10%, weighted to the second half”. It also noted that volume was constrained by consumer pricing, which is expected to moderate in the second half.

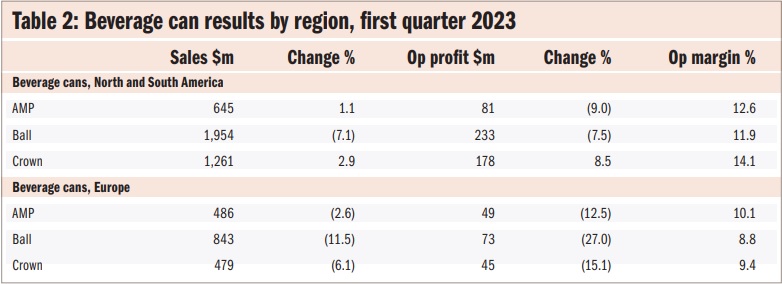

In North America, AMP’s volumes rose by 5%. The canmaker said it was encouraged by early signs of promotional activity, especially in non-alcoholic beverages. In Brazil, volume dropped by 1%, but, according to chief executive Oliver Graham, “demand is recovering slowly”. This is in contrast to a year ago, when volumes in Brazil dropped due to delays in the start of its annual Carnival, and in the FIFA World Cup soccer tournament.

This year, demand was limited by sustained higher retail pricing, but helped by “greater resilience of non-alcoholic categories”. At the same time, both cans for beer and hard seltzer declined in volume. The outlook was also impacted by a customer in Brazil filing for bankruptcy, although the impact on AMP was said to be small.

Volume in AMP’s European operations rose by 2%, with ebitda dropping by 12.5%, due in part to a lower euro-dollar exchange rate, and also higher input costs. Last year, AMP benefitted from at-home consumption of beer and other beverages, whereas this year, the quarter was led by carbonated soft drinks. Overall, AMP projects “low single digit percentage growth and a more significant increase in ebitda”.

Ardagh hasn’t been directly affected by the war in Ukraine because it doesn’t operate plants in Russia, but it has been impacted by rising energy costs. However, volume is growing in many parts of Europe, and it added beverage can capacity in the UK and in Germany, and at La Ciotat in the south of France. But the construction of AMP’s new plant in Northern Ireland, which would be close to customers Coca-Cola and Diageo, has reportedly been delayed.

AMP expects its capital spending to be “just below $400 million” this year. Its debt is fairly high in relation to cash generation, and management says it plans to reduce this.

Ball reported lower volumes and a drop in operating profit

Beverage can sales at industry leader Ball dropped by 8.4% in the first quarter, compared with last year, excluding its Russian operation which was divested last year, with all segments lower.

Management noted that this was “driven by varying macroeconomic conditions impacting consumer demand”. Chief executive Dan Fisher said that the second quarter “will remain choppy in the Americas as it works through higher inventory built up last year by customers to meet expected market needs and to hedge against continued sharp price increases”.

In Ball’s North and Central American market, mainly the US and Mexico, accounting for more than a half of its beverage can sales, there was a 6.5% decline in sales and a 4.9% drop in can volumes. This contrasts with a sharp gain in volume a year earlier. It also noted

that aluminium beverage cans continued to outperform other packaging in this challenging environment.

In South America, led by its operations in Brazil, volume dropped by 4%, but the canmaker projects significant improvement in the second half. Some of this was due to the same failure of a brewer, but it projects improvement in the second half. In the combined regions of the Americas, sales fell by 7% as detailed in Table 2.

In Europe, volume rose by 5%. Management indicated that there was a “continued mix shift to aluminium cans supported by ongoing favorable legislation”. Also, as others have reported, volume in Turkey dropped following the significant earthquakes impacting regional sales. New beverage can plants were opened at Kettering in the UK and at

Pilsen in Czech Republic to supply growing regional demand. Again, there was notable volume gain of 12.3%, in its non-reportable business segment, which includes impact-extruded aluminium aerosol cans and bottles, beverage cans in India, Saudi Arabia and Myanmar and aluminium drinks cups, which grew even faster in the quarter. Ball indicated that it continues to emphasise its next-generation lightweight refillable aluminium bottles (as opposed to its D&I Alumi-Tek bottles for beer and beverages).

Ball’s capital spending this year will be $1.2bn including continuing projects, but next year it plans a level closer to depreciation and amortisation, at $650m.

Crown’s volume falls but outlook strong

Global beverage can volume at Crown dropped by 1% in the first quarter. Chief executive Tim Donahue said it reflected “an inflation weary consumer and an economic slowdown in some markets”. He added that the company added more than 25 billion units or 30% more beverage can capacity globally year-on-year.

In Crown’s Americas segment, which represents more than 60% of its beverage can business, volume was up by 6%, driven by a 23% rise in Brazil, which was recovering from a sharp decline a year earlier due to poor weather and the subdued Carnival, and a 4% rise in North America.

Donahue noted that overall industry beverage can volume was down by 2% in the quarter, with “the entirety of the Analysis decline found in imported cans”. Thus, North America had flat volume, a good sign for the remainder of the year. In addition, can prices are projected to rise under its renewed customer contracts, recovering metal and other cost increases that soared last year.

New canmaking capacity will help Crown meet demand this year with a second line at Martinsville in Virginia, which is focusing on speciality cans, and its new plant at Mesquite in Nevada, which is expected to start operations in July, followed by a second line in October. In Brazil, its plant in the state of Minas Gerais is now operational. Again the impact of a customer in Brazil filing for bankruptcy protection had an effect on Crown’s results, but it indicated that there was adequate security for its receivables.

In Europe, beverage can volume declined by “high single-digits”, with notable weakness in Spain, the UK, and Turkey, where the impact was due to the recent earthquakes, although its plants weren’t directly impacted. Donahue indicated that price increases in its markets led some packers to “defer their purchase of cans closer to the summer

selling season”, with some earlier over-sourcing cans. While its segment income in Europe was down in the quarter, it expects to recover past cost increases as the year progresses.

In its Asia Pacific region, Crown’s volumes declined by double digits in almost every market. The canmaker noted that this was due to the impact of higher retail prices and overall inflation due in part to Covid and raw material costs.

Crown also noted that the “stressed consumer” in the region led to a slow Chinese New Year and wedding season. Volume in Vietnam was down, but Crown expects recovery in the second half.

Its Transit Packaging business had lower sales but reported a 28% gain in segment income. This was offset by a sharp fall in its business segment that includes food and aerosol can sales in the US, along with its UK-based CarnaudMetalbox Engineering canmaking equipment business which it said it had downsized due to lower-than expected order volumes.

Crown estimated that its capital spending for 2023 will be $900m. Free cash flow will be $500m, enabling the company to cut its leverage ratio, as it uses the majority of its free cash flow to reduce debt.